If a transaction is completely omitted from the accounting books, it will not unbalance the accounting equation. The accounting equation shows the amount of resources available to a business on the left side (Assets) and those who have a claim on those resources on the right side (Liabilities + Equity). Each entry on the debit side must have a corresponding entry on the credit side (and vice versa), which ensures the accounting equation remains true.

Accounting Equation: What It Is and How You Calculate It

Metro Courier, Inc., was organized as a corporation on January 1, the company issued shares (10,000 shares at $3 each) of common stock for $30,000 cash to Ron Chaney, his wife, and their son. Under the double-entry accounting system, each recorded financial transaction results in adjustments to a minimum of two different accounts. Ted is an entrepreneur who wants to start a company selling speakers for car stereo systems. After saving up money for a year, Ted decides it is time to officially start his business. He forms Speakers, Inc. and contributes $100,000 to the company in exchange for all of its newly issued shares.

- All basic accounting formulas discussed throughout this post highlight the importance of double-entry bookkeeping.

- The accounting equation equates a company’s assets to its liabilities and equity.

- Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

- The balance sheet is also known as the statement of financial position and it reflects the accounting equation.

The Accounting Equation: A Beginners’ Guide

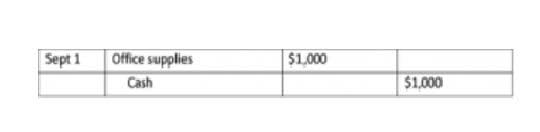

Below, we’ll cover the fundamentals of the accounting equation and the top business formulas businesses should know. Read end-to-end for a thorough understanding of accounting formulas or use the list to jump to an equation of your choice. As with all accounting, basic accounting formula as it is a double entry system, the basic accounting equation will always balance. Below are a few examples of how double entry adjusts the figures in the accounting equation. Current assets are assets that a company can turn into cash within one year.

Module 1: The Role of Accounting in Business

An asset is a resource that is owned or controlled by the company to be used for future benefits. Some assets are tangible like cash while others are theoretical or intangible like goodwill or copyrights. Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use. The major and often largest value assets of most companies are that company’s machinery, buildings, and property.

- Once you are done with these lessons be sure to check out the final lesson on the accounting equation and financial position, which will give you more info and certainty about this key concept.

- To summarize the diagram below sets out the fully expanded accounting equation.

- Suppose you’re attempting to secure more financing or looking for investors.

- Business owners with a sole proprietorship and small businesses that aren’t corporations use Owner’s Equity.

- The shareholders’ equity number is a company’s total assets minus its total liabilities.

- In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side.

For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability. Assets financed by investors and common Inventory will be listed as shareholder’s equity on your balance sheet. This equation is used to track a company’s financial health and ensure that its assets are not being overspent. In double-entry accounting or bookkeeping, total debits on the left side must equal total credits on the right side.

Accounting Formulas Every Business Should Know

- Share repurchases are called treasury stock if the shares are not retired.

- In other words, we can say that the value of assets in a business is always equal to the sum of the value of liabilities and owner’s equity.

- From the accounting equation, we see that the amount of assets must equal the combined amount of liabilities plus owner’s (or stockholders’) equity.

- The Accounting Equation is a fundamental principle that states assets must equal the sum of liabilities and shareholders equity at all times.

If the left side of the accounting equation (total assets) increases or decreases, the right side (liabilities and equity) also changes in the same direction to balance the equation. Below are some of the most common accounting equations businesses should know. This accounting equation is used to track the financial health of a company by ensuring that its assets always equal its liabilities plus its equity. The Basic Accounting Equation is also known as the balance sheet equation. Below are some of the most common accounting equations that businesses should know.

Basic Accounting Equation: Assets = Liabilities + Equity

The owner’s equity is the balancing amount in the accounting equation. One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The accounting equation is based on the premise that the sum of a company’s assets is equal to its total liabilities and shareholders’ equity.

Accumulated Other Comprehensive Income (Loss), AOCIL, is a component of shareholders’ equity besides contributed capital and retained earnings. Because the Alphabet, Inc. calculation shows that the basic accounting equation is in balance, it’s correct. Accounting software is a double-entry accounting system automatically generating the trial balance. The trial balance includes columns with total debit and total credit transactions at the bottom of the report. The monthly trial balance is a listing of account names from the chart of accounts with total account balances or amounts.