Remember to review the account terms carefully, as some high-yield business checking accounts require you to meet certain activity and balance requirements to receive the advertised APY. We chose the First Internet Bank’s business checking for the treasury management services that come with its Commercial Analyzed Checking account. These include commercial deposit services, payables and receivables, and sweep services. The account also comes with credit card processing and corporate credit cards. In contrast, a small business savings account stores funds you don’t need immediately. It generally provides higher interest rates than checking but may have monthly withdrawal limits.

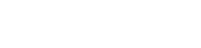

How to set up a small business accounting system

There is a $25 monthly fee that can be waived by maintaining an account balance of $1,500 in combination with a TD Bank personal checking account. The TD Business Premier Checking and TD Business Interest Checking Plus accounts also scored highly and offer additional benefits, like interest or lowered service fees. TD Bank maintains a network of 1,100 branches and 2,600 ATMs, primarily along the East Coast.

More on our picks for best business checking accounts

This account is recommended for LLCs with smaller balances that value customer service. To find the 10 best small business checking accounts for you, we reviewed more than 100 banks. Our experts chose First Internet Bank as the best online bank for small businesses because it has low fees and high interest rates on business accounts. Its First Internet Bank Do More Business™ Checking earns 0.50% APY for accounts with an average daily balance of $10,000 and has no transaction limits or monthly service fees.

Axos Bank Basic Business Checking

We picked the Axos Bank Business Interest Checking account because it offers several free business services and earns competitive interest. It also comes with access to dedicated Axos Bank relationship managers. The NBKC Bank Business Checking Account is best for smaller businesses that want to save on banking and have the flexibility to let their balances fluctuate. It’s ideal for those without complicated money management or app integration needs. U.S. Bank typically offers promotions for opening certain new accounts. Chase may offer special promotional offers for opening a new business account; check for available Chase Bank account bonuses before making a decision.

When To Choose Bank of America’s Business Advantage Fundamentals Banking

Accounting for small businesses is done by keeping a complete record of all the income and expenses and accurately extracting financial information from business transactions. Truist offers online and mobile banking for small total absorption costing businesses, recommending the Simple Business Checking account. TD Bank offers small businesses banking lending services and opportunities. First Internet Bank’s business banking solutions are conveniently located online.

NBKC Bank: Best Personal Accounts

Based on customer feedback, service providers, like communication companies and insurance providers, are also navigating the economic shift through increased targeted marketing efforts. Service providers are leveraging data to identify growth opportunities among small businesses. At the same time, there’s a heightened awareness of potential fraud risks. Taking online courses can be a great way to learn the basics of accounting for your business.

The U.S. Bank Silver Business Checking Account Package package is another worthy option from this bank. This package has no monthly maintenance fee and offers reduced deposit and transaction limits for businesses with less activity. We like this account because it has many perks for sole proprietors. Although the cash deposit limit of $25,000 and low fees may appeal to any business, the account lets sole proprietors count personal balances toward fee waiver requirements.

Try to find an account that doesn’t charge a monthly maintenance fee or one that has a fee that can be waived easily. You may be able to waive some fees by maintaining a certain balance. For instance, Regions Bank waives the monthly service fee for those generating $500 or more in Regions Business CheckCard and or business credit card purchases. The Found business checking account can be an excellent choice if you’re a freelancer or independent contractor. The account requires no monthly fees or minimum balance — and it’s free to sign up. As the name suggests, a high-yield business checking account usually offers a higher APY than a standard business checking account.

A credit union’s small business accounts may offer lower fees on deposit accounts and pay higher interest, compared to a traditional bank, while also offering $250,000 in NCUA insurance. A business bank account is a specialized account worker misclassification: why the irs cares & you should too business owners use to manage their finances. Unlike personal accounts, they’re designed to handle larger volumes of transactions and offer features tailored to business operations, like payroll services or merchant payment processing.

An accountant may be able to advise you on which legal structure is best for your business, depending on its size, complexity, number of founders, and other factors. A journal entry is a financial transaction entry in the general ledger. Accounts receivable is the money that other entities owe to your business.

Both offer some invoicing tools, though we don’t like them as well as Azlo’s. NBKC offers invoicing through Autobooks, but it costs $10 a month after a two-month free trial. Novo’s invoicing is free, but it doesn’t (yet) work on its mobile apps, making it less convenient. By providing feedback on how we can improve, you can earn gift cards and get early access to new features.

“But to have to also do all of the financial end of things … it’s not what they enjoy doing. So if they can have a good relationship with the bank, where the bank’s handling a lot of that stuff for them, you’re making it more efficient for them and saving some of their time,” she adds. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site.

If time is of the essence, Small Business Bank’s fast approval times might interest you. For businesses that plan to make it big, Axos Bank’s business interest checking has plenty of options to scale with you. And Lili has great tools and perks for freelancers or other solopreneurs. With pretty much any checking account, you’ll get a free debit card.

U.S. Bank offers several business and small business banking solutions, including tiered business checking accounts. Some business checking accounts impose a transaction limit, meaning only a predetermined number of monthly transactions are ebitda explained in simple terms included in the base cost of your account. If you have a lot of account activity each month, you may want to choose an option that includes unlimited transactions. The Basic account has no fees, no initial deposits, or minimum balance.

Depending on the business’s needs and earnings, you may also want to open a small business savings account. Just make sure you can meet the minimum requirements to avoid paying a monthly fee. Bluevine Business Checking is great if you’re a small business owner.

- The Wells Fargo Business Market Rate Savings account is designed for small businesses that want to earn interest on a little extra cash worry-free.

- Both offer some invoicing tools, though we don’t like them as well as Azlo’s.

- We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

- First Internet Bank has two business checking accounts, a regular business savings account, a business money market account and business CDs with terms ranging from three months to five years.

You could opt for our favorite bank for checking, Bluevine, or several of the other banks we recommend above. Many other business apps, such as PayPal, Xero and Gusto, integrate with your Novo checking account. Claire is a senior editor at Newsweek focused on credit cards, loans and banking. Her top priority is providing unbiased, in-depth personal finance content to ensure readers are well-equipped with knowledge when making financial decisions. We spend hours researching and evaluating each business banking service we review at Merchant Maverick, placing special emphasis on key characteristics to generate our ratings. There are also transaction limits for each account, so if you go over 200 transactions on the Fundamentals Banking plan or 500 transactions on the Relationship Banking plan, you’ll have to pay extra.

With all that, it’s easy to see why Bluevine has the best business checking account for most business owners. That’s partially because Bluevine has interest-bearing checking, letting you earn up to 2.0% interest on balances of up to $250,000. That’s the best rate we’ve found for business interest checking (although you do have to qualify by using your Bluevine debit card or receiving payments in your account). You can open an account fast, and your funds are FDIC-insured up to $3 million dollars. Anyone who has a business, small or large, can benefit from a business checking account. It helps you track your revenue and expenses so that you can understand the business’s financial performance before transferring the money to your personal account for spending.

The best free business checking accounts should have either no or easily waivable monthly fees. Banks that don’t charge monthly fees include Bluevine, U.S. Bank, Novo, Mercury, Grasshopper, Found, and Relay. Banks with easily waivable monthly fees are Bank of America, Chase, and Capital One. Axos Basic Business Checking is a straightforward account with no monthly maintenance fees, no initial deposit or minimum balance requirements, free domestic incoming wires and unlimited transactions. Capital One is a household name in banking with brick-and-mortar locations, as well as access to over 70,000 in-network Capital One, MoneyPass® and Allpoint® ATMs.

Technically, if your business is operating as a sole proprietorship, then you’re not required to have a business account (although it’s still recommended for keeping business transactions separate from personal ones). You can use a personal account, which can offer added convenience when you’re first starting out. As your business grows or if you transition to a Limited Liability Company (LLC), then you can select a business banking option for separation. If you tend to keep a significant sum in your account, you may earn enough interest to offset bank fees or cover other company expenses. With Square Banking, profits from your sales hit your bank instantly. Square Banking also has no monthly fees, low additional fees, cash flow management, and seamless integrations to other Square products, making this checking account a great option for Square users.

When rating banks and banking services, we use a 53-point rubric that looks at rates and fees, services, eligibility requirements, application, sales and advertising transparency, customer service, and user reviews. We weigh each section differently to calculate the total star rating. Lili Bank is another online bank that has a really unique focus — accounting and bookkeeping. Lili has built-in bookkeeping features including tax support, invoicing, bill pay, expense tracking, and reporting. If you’re looking for basic bookkeeping built directly into your checking account, Lili is one of the only banks to offer this feature set. Axos offers impressive business banking rewards, including up to 1.0% APY and a competitive cash welcome bonus (currently valued at $400).